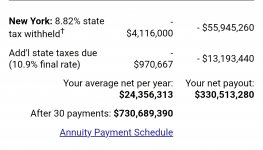

Absolutely absurd how much they take out in taxes. I'm not expecting 50% but 330M out of 1.4B isn't even 25% if you take the lump sum

View attachment 71219

Winning a $1.4 billion lottery jackpot in Florida means you would pay significant federal taxes, but zero state taxes. This is because Florida does not have a state income tax.

Here is an estimate of your net winnings if you chose the popular lump-sum cash option, based on recent analysis.

Lump-sum cash option

Most lottery winners opt for the immediate cash payout instead of annual annuity payments. For a jackpot of $1.4 billion, the pre-tax lump-sum cash value is typically around 45% of the total prize, or approximately $634.3 million.

Federal taxes

The Internal Revenue Service (IRS) taxes lottery winnings as ordinary income and will take two cuts from your winnings:

Initial 24% withholding: The lottery commission automatically withholds 24% for federal taxes. On a $634.3 million lump sum, that's a reduction of about $152.2 million.

Final 37% tax bracket: Your winnings will place you in the highest federal tax bracket, which is 37% for 2025. This means you will owe an additional 13% ($82.5 million) when you file your income taxes.

Estimated net winnings

After deducting the federal taxes, here is the approximate amount you would take home:

Initial cash value: $634.3 million

Total federal tax (approx. 37%): -$234.7 million

Estimated net after federal tax: $399.6 million

Annuity option

If you choose the annuity, you would receive an initial payment followed by 29 annual payments, which increase by 5% each year. While the federal tax rate would still be 37%, you would only pay taxes on the amount of each annual payment as you receive it. After the 37% federal tax, your net would be an estimated $883.3 million over 30 years.

lost so I was never hitting anything cuz I never had FAA in any parlays. Only pending parlay is this pathetic $10 freebie for linking my ESPN+ account